Send

AED

Receive

USD

- INR - INDIA

- PHP - PHILIPPINES

- PKR - PAKISTAN

- EGP - EGYPT

- JOD - JORDAN

- BDT - BANGLADESH

- LKR - SRI LANKA

- NPR - NEPAL

- AUD - AUSTRALIA

- BHD - BAHRAIN

- CAD - CANADA

- CHF - SWITZERLAND

- EUR - AUSTRIA

- EUR - BELGIUM

- EUR - BULGARIA

- EUR - CYPRUS

- EUR - DENMARK

- EUR - ESTONIA

- EUR - FINLAND

- EUR - FRANCE

- EUR - GERMANY

- EUR - GREECE

- EUR - HUNGARY

- EUR - IRELAND

- EUR - ITALY

- EUR - KOSOVO

- EUR - LUXEMBOURG

- EUR - MALTA

- EUR - NETHERLANDS

- EUR - NORWAY

- EUR - PORTUGAL

- EUR - ROMANIA

- EUR - RUSSIA

- EUR - SLOVAKIA

- EUR - SLOVENIA

- EUR - SPAIN

- EUR - SWEDEN

- EUR - VATICAN CITY STATE

- GBP - SCOTLAND

- GBP - UNITED KINGDOM

- HKD - HONG KONG

- IDR - INDONESIA

- IQD - IRAQ

- JOD - PALESTINE

- JPY - JAPAN

- KWD - KUWAIT

- LBP - LEBANON

- MAD - MOROCCO

- MYR - MALAYSIA

- NZD - NEW ZEALAND

- OMR - OMAN

- QAR - QATAR

- SAR - SAUDI ARABIA

- SGD - SINGAPORE

- THB - THAILAND

- TND - TUNISIA

- USD - AFGHANISTAN

- USD - ALBANIA

- USD - ALGERIA

- USD - ANDORRA

- USD - ANGOLA

- USD - ARGENTINA

- USD - ARMENIA

- USD - AZERBAIJAN

- USD - BAHAMAS

- USD - BARBADOS

- USD - BELARUS

- USD - BELIZE

- USD - BENIN

- USD - BERMUDA

- USD - BHUTAN

- USD - BOLIVIA

- USD - BOSNIA HERZeg

- USD - BOTSWANA

- USD - BRAZIL

- USD - BRUNEI

- USD - BURKINA FASO

- USD - BURUNDI

- USD - C AFRICAN REPUBLIC

- USD - CAMBODIA

- USD - CAMEROON

- USD - CAPE VERDE

- USD - CAYMAN ISLANDS

- USD - CHAD

- USD - CHILE

- USD - CHINA

- USD - COLOMBIA

- USD - COMOROS

- USD - CONGO

- USD - COSTA RICA

- USD - COTE D IVOIRE

- USD - CROATIA

- USD - CUBA

- USD - CURACAO

- USD - CZECH REPUBLIC

- USD - DJIBOUTI

- USD - DOMINICA

- USD - DOMINICAN REPUBLIC

- USD - EAST TIMOR

- USD - ECUADOR

- USD - EL SALVADOR

- USD - ERITREA

- USD - ETHIOPIA

- USD - FALKLAND ISLd

- USD - FIJI

- USD - GABON

- USD - GAMBIA

- USD - GEORGIA

- USD - GHANA

- USD - GIBRALTAR

- USD - GRENADA

- USD - GUATEMALA

- USD - GUINEA

- USD - GUINEA BISSAU

- USD - GUYANA

- USD - HAITI

- USD - HONDURAS

- USD - ICELAND

- USD - JAMAICA

- USD - KAZAKHSTAN

- USD - KENYA

- USD - KIRIBATI

- USD - KYRGYZSTAN

- USD - LAOS

- USD - LATVIA

- USD - LESOTHO

- USD - LIBERIA

- USD - LIECHTENSTEIN

- USD - LITHUANIA

- USD - MACEDONIA

- USD - MADAGASCAR

- USD - MALAWI

- USD - MALDIVES

- USD - MALI

- USD - MARSHALL ISLANDS

- USD - MAURITANIA

- USD - MEXICO

- USD - MICRONESIA

- USD - MOLDOVA

- USD - MONACO

- USD - MONGOLIA

- USD - MONTENEGRO

- USD - MOZAMBIQUE

- USD - Mauritius

- USD - NAMIBIA

- USD - NAURU

- USD - NICARAGUA

- USD - NIGER

- USD - NIGERIA

- USD - PALAU

- USD - PANAMA

- USD - PAPUA NEW GUINEA

- USD - PARAGUAY

- USD - PERU

- USD - POLAND

- USD - PUERTO RICO

- USD - REPUBLIC OF CONGO

- USD - RWANDA

- USD - SAINT KITTS AND NEVIS

- USD - SAINT LUCIA

- USD - SAMOA

- USD - SAN MARINO

- USD - SAO TOME PRINCIPE

- USD - SENEGAL

- USD - SERBIA

- USD - SEYCHELLES

- USD - SIERRA LEONE

- USD - SOLOMON ISLANDS

- USD - SOMALIA

- USD - SOUTH AFRICA

- USD - SOUTH KOREA

- USD - SURINAME

- USD - SWAZILAND

- USD - TAIWAN

- USD - TAJIKISTAN

- USD - TANZANIA

- USD - TOGO

- USD - TONGA

- USD - TRINIDAD TOBAGO

- USD - TURKEY

- USD - TUVALU

- USD - UGANDA

- USD - UKRAINE

- USD - URUGUAY

- USD - Uzbekistan

- USD - VANUATU

- USD - VENEZUELA

- USD - VIETNAM

- USD - ZAMBIA

- USD - ZIMBABWE

- USD - ST VINCENT GRENADINES

- YER - YEMEN

1 AED = Indicative exchange rate

Transfer Method

Call Us on600 54 6000

Head Office

Level 7, Al Ansari Business Center,

Al Barsha 1, Beside Mall of the Emirates

P.O.Box 6176, Dubai, UAE.

Email: [email protected]

+250

Branches

across the UAE

+3M

Unique

customers

+500K

Banks and agent

locations worldwide

+50

Years

of trust

Money transfer in the UAE

For over 60 years, Al Ansari Exchange has been the leading exchange company in the UAE. We provide online money transfer services, online and offline remittance, foreign exchange services and much more to thousands of customers every day.

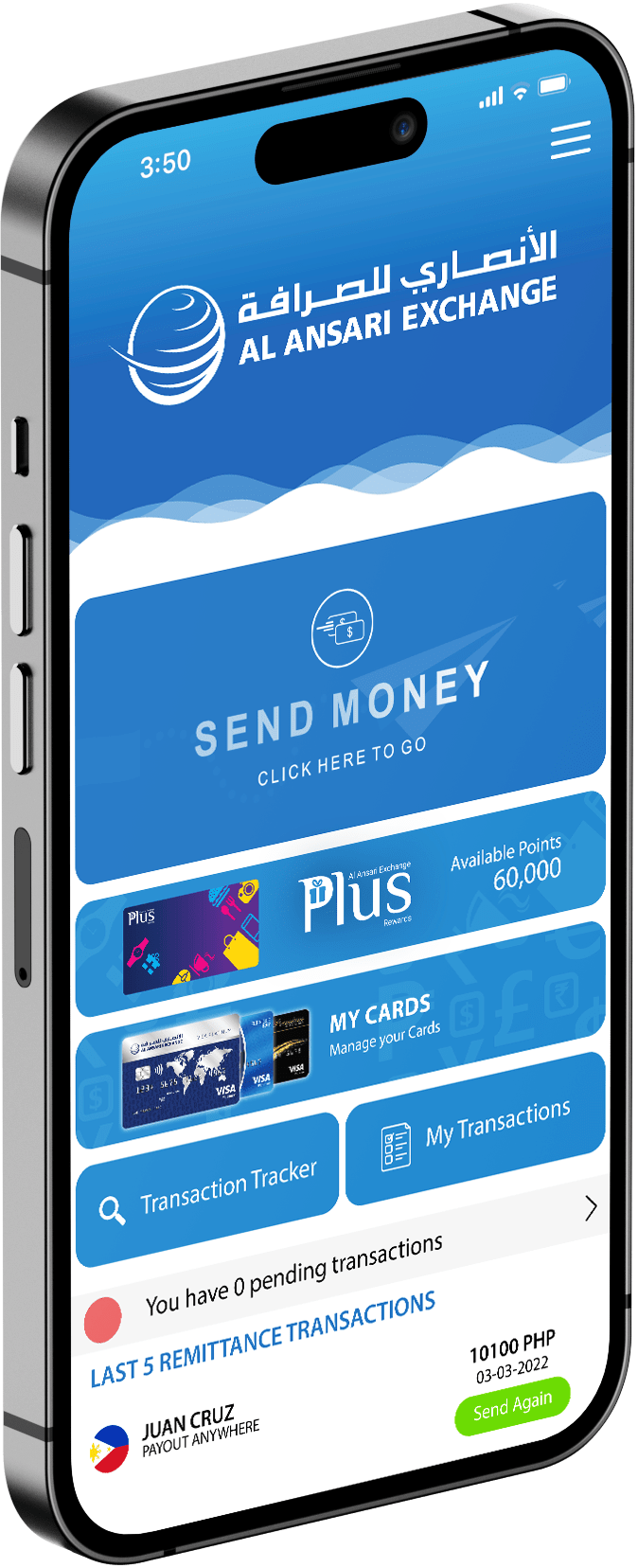

We boast the largest network of branches in the UAE, connecting millions of people around the globe. Apart from offering the best way to transfer money from the UAE, our wide range of financial services also includes prepaid cards, corporate payment solutions, and bill payments. Moreover, our mobile app enables you to quickly and securely access those services. Money transfer has never been so convenient.